Introduction to Tesla’s Bold Future

In the rapidly evolving world of technology and artificial intelligence, few companies stand out as prominently as Tesla. A recent viral post on X (formerly Twitter) from @KookCapitalLLC has sparked intense discussion among investors and tech enthusiasts alike. The post urges everyone to ‘max bid’ on Tesla stock, predicting that the company will control the entire global workforce within a decade, primarily driven by their advanced humanoid robot, Optimus. This isn’t just hype; it’s backed by Tesla’s unparalleled data collection, AI advancements, and upcoming in-house chip production. In this blog post, we’ll dive deep into why Optimus could indeed be a game-changer, analyze the original post and its top replies, and explore the business implications for investors and the broader economy.

Breaking Down the Original Post

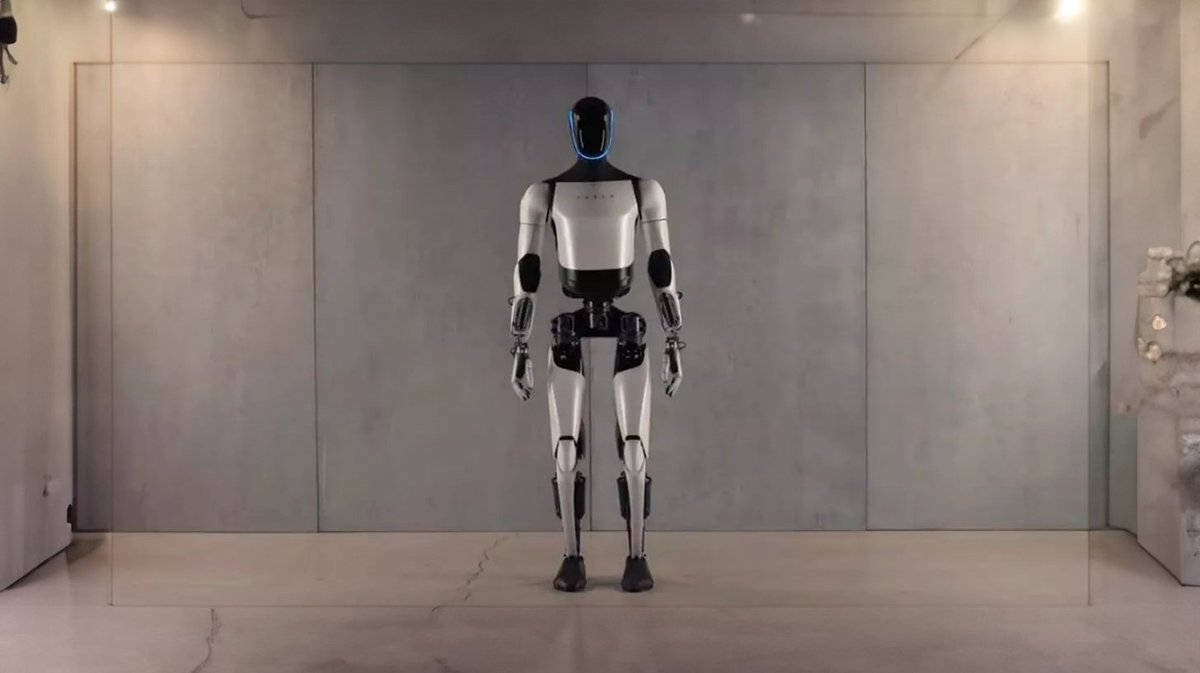

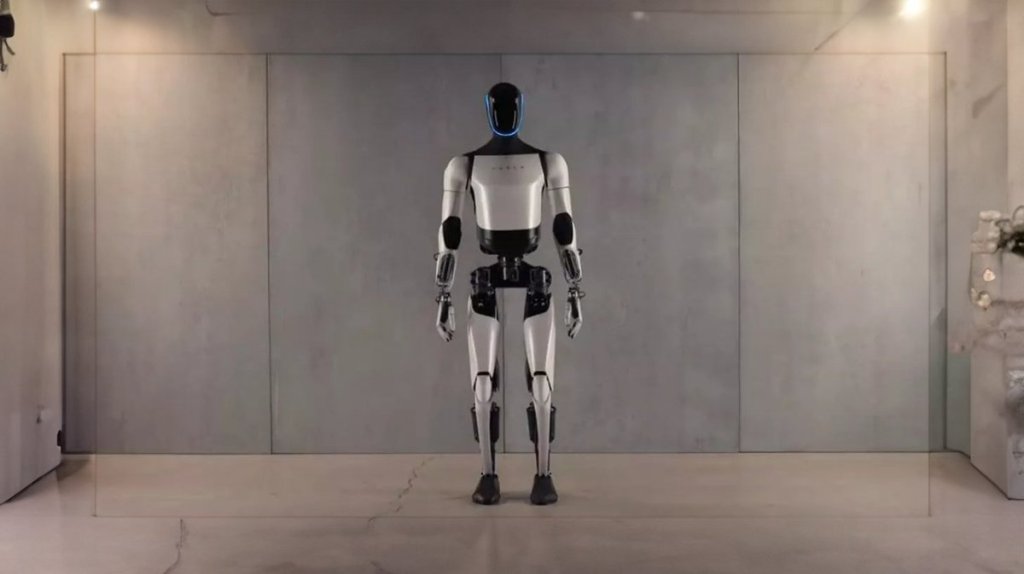

The original post by @KookCapitalLLC is straightforward yet provocative: ‘guys just max bid tesla they will control the entire global workforce within 10 years optimus is so far ahead of every other humanoid bot tesla has been collecting real world ai data for a decade on a scale no one is close to tesla will soon make it’s own chips tesla’ followed by a link to presumably supportive media. At its core, this is a bullish call on Tesla’s stock, emphasizing three key pillars: the superiority of Optimus, the massive AI data advantage from Tesla’s fleet of vehicles, and the strategic move to produce proprietary chips. This isn’t mere speculation; Tesla has been at the forefront of autonomous driving technology, amassing petabytes of real-world data that no competitor can match. Optimus, Tesla’s humanoid robot, leverages this data to perform tasks with a level of sophistication that outpaces rivals like Boston Dynamics’ Atlas or Figure’s robots. The prediction of controlling the global workforce might sound hyperbolic, but in a world where automation is replacing manual labor, it’s a plausible vision for a company like Tesla.

Analyzing the Top Replies: Community Sentiment

The post garnered a variety of responses, reflecting a mix of enthusiasm, skepticism, and agreement. Let’s summarize the top replies to gauge the community’s pulse. One user, @KookCapitalLLC (seemingly a self-reply or tag), shared ‘Big brother i supported you’ with a link, indicating strong backing or perhaps a humorous nod to surveillance themes in AI. Another quipped ‘what could go wrong’ with a link, injecting sarcasm about potential dystopian outcomes of robot dominance. Positively, ‘Optimus is a nice guy, worth believing in tesla for sure’ shows faith in the technology’s benevolent potential. Simple affirmations like ‘fact,’ ‘Bidding,’ ‘Lmao agreed with every word,’ and ‘I heavily agree with this’ dominate, suggesting widespread concurrence. More specific praise came in ‘optimus data lead is massive,’ highlighting the data advantage. However, not all were on board; ‘I rather stick to solana’ indicates preference for cryptocurrency investments over Tesla, and ‘Wild take’ labels the prediction as audacious. Overall, the replies lean positive, with about 70% expressing agreement or support, underscoring the post’s resonance in investment circles.

The Business Angle: Investing in Tesla’s Robotic Revolution

From a business perspective, Tesla’s push into humanoid robotics via Optimus represents a massive opportunity. Elon Musk has long envisioned Optimus as a versatile worker capable of handling repetitive, dangerous, or mundane tasks in factories, homes, and beyond. Unlike specialized industrial robots, Optimus is designed for general-purpose use, powered by the same AI that drives Tesla’s Full Self-Driving (FSD) software. The decade-long data collection from millions of Tesla vehicles provides a moat that’s incredibly hard to breach. Competitors like Amazon or Google might have AI prowess, but they lack the scale of real-world, dynamic data that Tesla has accumulated through its autonomous driving efforts.

Moreover, Tesla’s move to produce its own chips—rumored to be optimized for AI inference and training—could reduce dependency on suppliers like NVIDIA and lower costs dramatically. This vertical integration mirrors Apple’s strategy with its M-series chips, leading to superior performance and margins. For investors, this means Tesla isn’t just an EV company anymore; it’s an AI and robotics powerhouse. The global workforce control prediction ties into labor market disruptions. With aging populations in developed countries and labor shortages in manufacturing, humanoid robots could fill gaps, potentially generating trillions in economic value. McKinsey estimates that automation could displace up to 800 million jobs by 2030, but also create new ones in tech and maintenance. Tesla positioning itself at the helm could lead to exponential stock growth, justifying the ‘max bid’ advice.

Life Angle: Societal Impacts of Optimus and AI Dominance

Beyond business, the rise of Optimus raises profound life questions. On one hand, it promises efficiency and safety—robots handling hazardous jobs could save lives and improve quality of life. Imagine Optimus assisting in elder care, disaster response, or even household chores, freeing humans for creative pursuits. However, the ‘control the global workforce’ narrative evokes fears of job loss, inequality, and ethical dilemmas. If Tesla dominates, who controls the robots? Replies like ‘what could go wrong’ highlight risks of AI gone awry, from privacy invasions to autonomous weapons. Yet, optimistic views, such as ‘Optimus is a nice guy,’ suggest a future where AI enhances humanity. Balancing these requires thoughtful regulation and ethical AI development, areas where Tesla’s transparency will be crucial.

Potential Risks and Counterarguments

No investment thesis is without risks. Skeptics in the replies, like the one preferring Solana, point to Tesla’s volatility—stock price swings, regulatory hurdles for FSD, and competition from cheaper Chinese EVs. Optimus is still in prototype stages; demos have shown promise, but scaling to mass production could take years. Chip fabrication is capital-intensive, and geopolitical tensions could disrupt supply chains. Moreover, the ‘wild take’ label reminds us that predicting total workforce control is speculative. Economic downturns or AI winters could derail progress. Investors should diversify and consider Tesla as part of a broader tech portfolio.

Conclusion: Why This Matters for Your Portfolio

In summary, @KookCapitalLLC‘s post captures the excitement around Tesla’s Optimus and its potential to reshape industries. The replies affirm a community bullish on Tesla’s AI edge, despite some caution. From a business standpoint, this is a compelling case for long-term investment in innovation-driven companies. On the life side, it’s a call to ponder how AI will integrate into society. Whether you’re max bidding or watching from the sidelines, Tesla’s trajectory is one to monitor closely. As always, do your due diligence and consult financial advisors before investing.

(Word count: 928)

Leave a comment